The Importance of Having Good Credit

Empowering Your Credit Repair Business: Lessons from a Turo Booking Experience

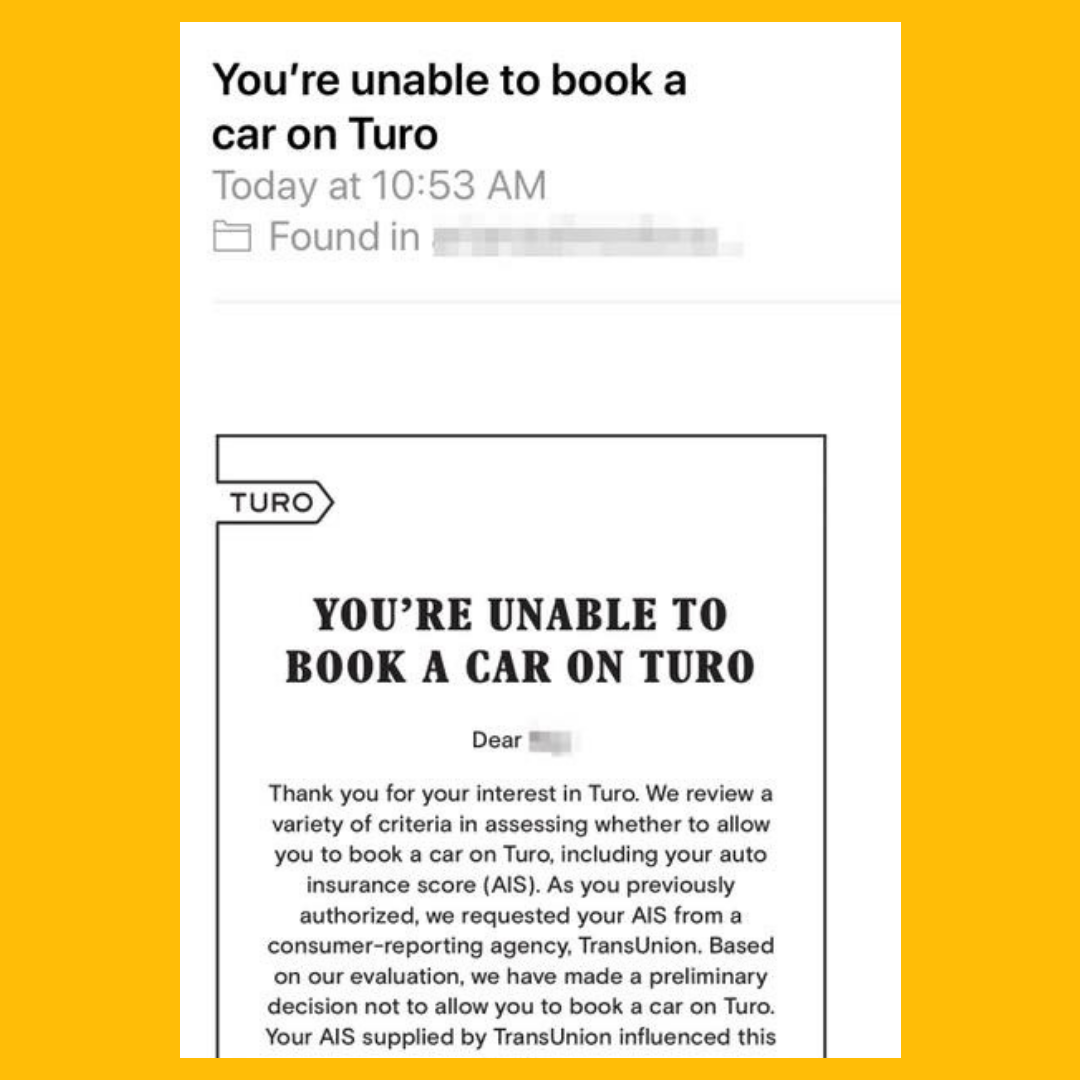

When Score vice president Ary Carmona tried to book a car on Turo, a car-sharing marketplace that allows users to book cars from local hosts, she read the following reply: “You’re unable to book a car on Turo.” because she did not have a good credit.

According to the email, Turo reviews a variety of criteria in assessing whether to allow a user to book a car, including an auto insurance score (AIS). Once she gave authorization, the company requested her AIS from TransUnion. Based on their evaluation, “we have made a preliminary decision not to allow you to book a car on Turo. Your AIS supplied by TransUnion influenced this decision.”

Turo relayed that our VP had the “right to dispute the accuracy or completeness of the information provided to us by contacting the consumer agency directly within 60 days of receiving this notice.”

A bad credit score can influence the outcomes of a loan application or a home purchase. That’s when credit repair businesses come in.

Your business and your clients are our absolute priority. That’s why we have produced the best credit repair business software, ScoreCEO, and made it sleek and easy to use. After all, the less time you spend figuring it all out, the more time you can spend marketing and gaining new clients. Visit scoreceo.com today.

Conclusion:

In summary, Turo’s experience highlights the significance of credit scores. It shows the need for good credit maintenance. Credit repair businesses are crucial in this process. They aid clients in overcoming these challenges. Utilizing tools like ScoreCEO boosts efficiency. This leads to client success and business growth. Effective management opens doors for both individuals and businesses alike.

To learn more, Visit ScoreCEO.

For more Education on credir repair, Visit ScoreWayU today.

Comments are closed.